Maturity value compound interest calculator

Assessing human life for its economic value is a useful tool for insurance companies to determine the amount of money a family needs in case of death of the sole earning member. A t A 0 1 r n.

Maturity Value Calculator Calculator Academy

The formula can be used to calculate the reverse interest rate when one has maturity value to know the true rate of interest earned on the investment as we did in our last example.

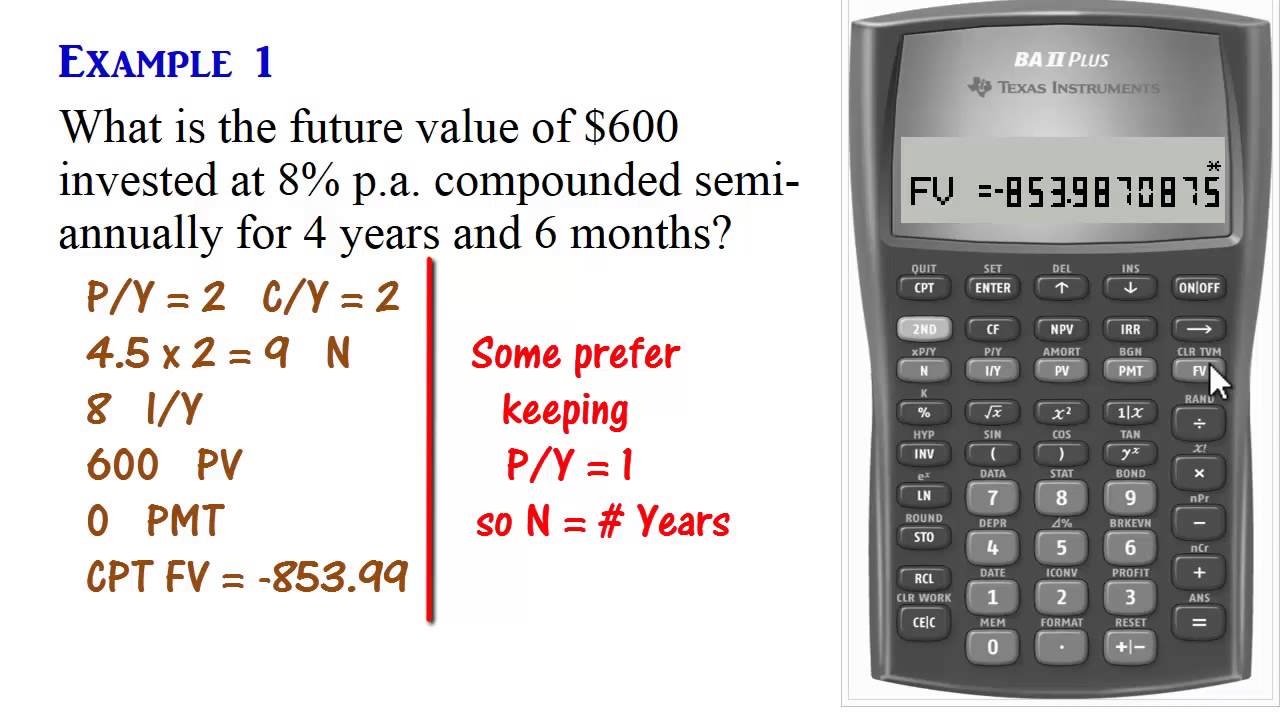

. Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. The calculation of compound interest can involve complicated formulas. Interest paid in year 1 would be 60 1000 multiplied by 6 60.

Search for a reputable site. The formula for the approximate yield to maturity on a bond is. Only after the first quarter the interest starts compounding.

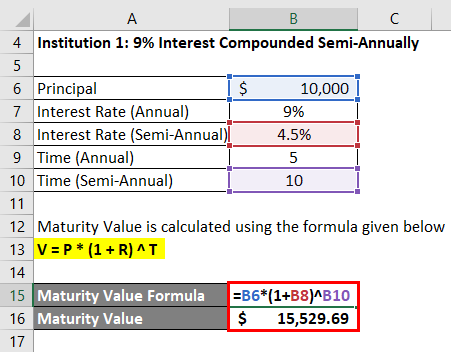

You can learn more about Excel Modeling from the following articles Compound Interest Examples Compound Interest Examples To calculate the compound interest in excel the user can use the FV function and return the future value of an investment. MR1i n-11-1i-13 Where M Maturity value. Our calculator provides a simple solution to address that difficulty.

Treasury savings bonds pay out interest each year based on their interest rate and current value. Calculate interest compounding annually for year one. In reverse this is the amount the bond pays per year divided by the par value.

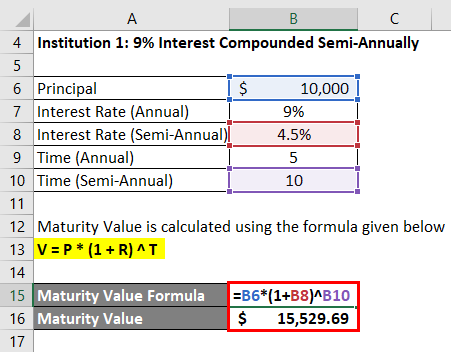

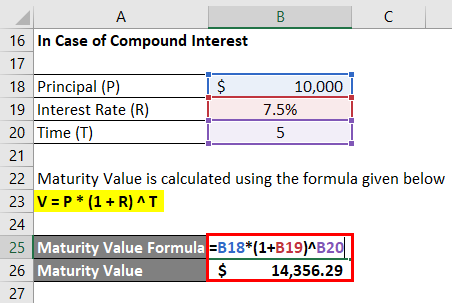

Compound interest will result in higher maturity value than simple interest rate if the rate of interest is the same. It offers an attractive Interest Rate of 71 that is fully exempt from tax under Section 80C. To compute compound interest we need to follow the below steps.

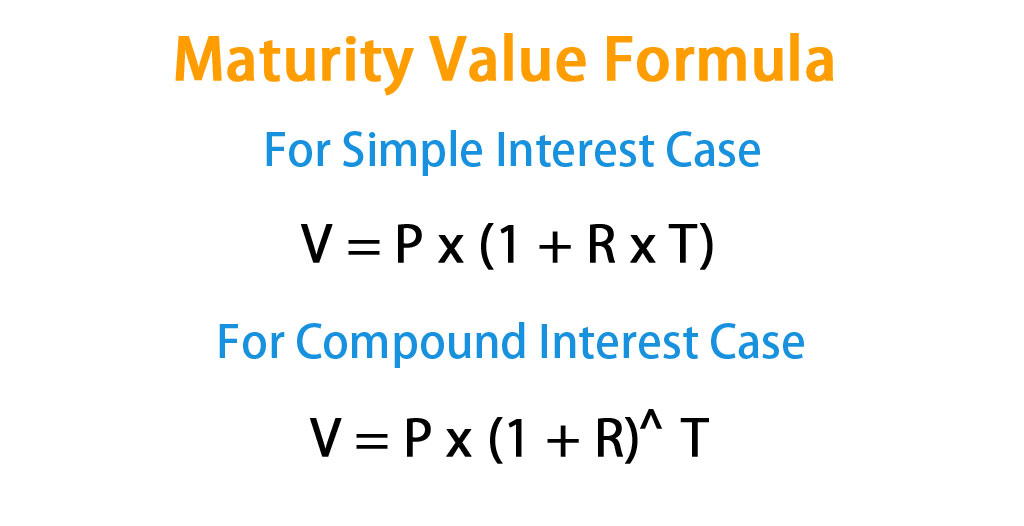

V is the maturity value P is the original principal amount and n is the number of compounding intervals from the time of issue to maturity date. Maturity value of RD. The amount invested is allowed as a deduction the interest earned and maturity amount is tax-free.

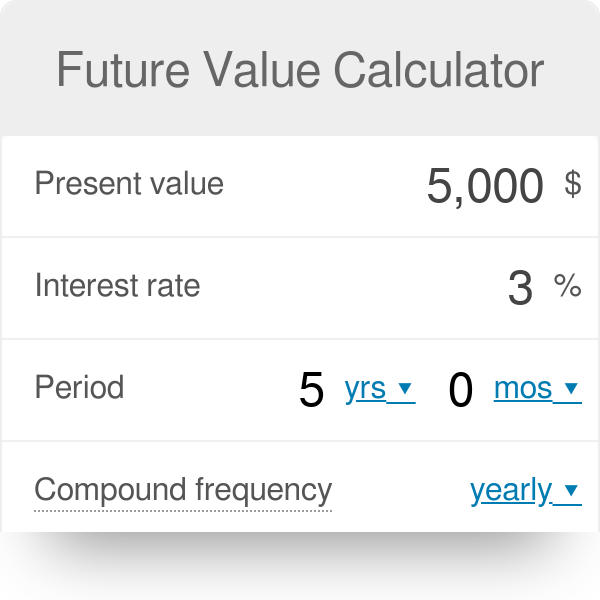

Note here that in case you make a deposit in a bank eg put money in your saving account from a financial perspective it means that you. You see that V P r and n are variables in the formula. As you may remember we deposited 2000 for 5 years into a savings account at 8 annual interest rate compounded.

Compound Interest CI Earned over 3 years Maturity Amount Principal Amount. In this case if the interest rate used in the calculation is 20 there is no difference between the two. Assume that you own a 1000 6 savings bond issued by the US Treasury.

The detailed explanation of the arguments can be found in the Excel FV function tutorial. This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value coupon rate market rate interest payments per year and years-to-maturity. So for example if you plan to invest a certain.

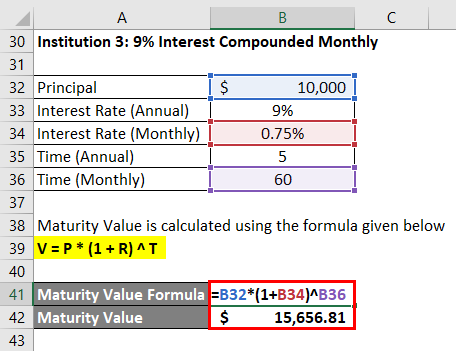

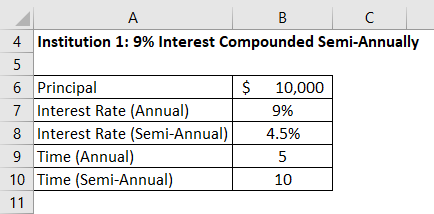

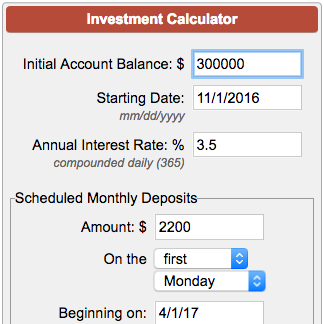

Secondly in the case of compound interest investors will also have to look at the frequency of the compounding because the frequency of compounding has a direct impact on the maturity value. Banks use the following formula for RD interest calculation in India or the maturity value of RD. Plus the calculated results will show the step-by-step solution to the bond valuation formula as well as a chart showing the present values of the par.

Use two different calculators to validate your. The quality and usability of each online calculator tool can vary greatly. CI 13449 10000 Rs.

Bond Face ValuePar Value - Par or face value is the amount a bondholder will get back when a bond matures. However those who want a deeper understanding of how the calculations work can refer to the formulas below. The variable r represents that periodic interest rate.

Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. Factors Affecting Fixed Deposit Interest Rates. If you own a money market fund for example type in money market fund maturity value calculator.

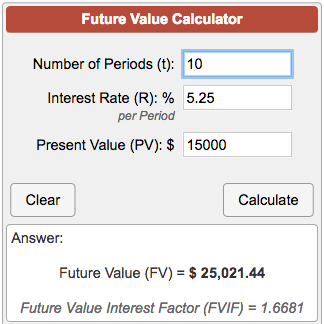

Where A final amount including interest P principal amount r annual interest rate as decimal n number of compounds per year t number of. Future value FV is a measure of how much a series of regular payments will be worth at some point in the future given a specified interest rate. Based on quarterly compounding M R1in 11-1i -13 Where M Maturity value of the RD.

For example when an investor starts their RD in the month of February the amount will earn only simple interest until the month of March. Good long term investment for 15 years. Compound Interest Explanation.

The following formula can be used to find out the compound interest. The basic formula for compound interest is as follows. To understand the differences between compounding frequencies or to do calculations involving them please use our Compound Interest Calculator.

To calculate the maturity value of an RD the following formula is used. Find out the initial principal amount that is required to be invested. Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and.

Annual Interest Payment Face Value - Current Price Years to Maturity Face Value Current Price 2 Lets solve that for the problem we pose by default in the calculator. Zero-coupon CDs are bought at fractions of their par values face value or amount received at maturity and generally have longer terms compared to traditional CDs which can expose. In finance interest rate is defined as the amount that is charged by a lender to a borrower for the use of assetsThus we can say that for the borrower the interest rate is the cost of debt and for the lender it is the rate of return.

How is Interest on RD Calculated. Most banks that offer recurring deposits compound the interest on a quarterly basis. Human life value is the monetary worth placed on a human life.

In the meantime lets build a FV formula using the same source data as in monthly compound interest example and see whether we get the same result. Using the Bond Price Calculator Inputs to the Bond Value Tool. A P1 rn nt.

The 100000 is the present value and the 120000 is the future value of your money. Here we also provide a Simple Interest Calculator with a downloadable excel template. Compound Interest is calculated on the principal amount and also on the interest of previous periods.

The rate of interest is dependent on the rates declared by the Government of India. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. To compound interest you multiply the periodic rate by the face amount.

For example if a sum of Rs 10000 is invested for 3 years at 10 compound interest rate quarterly compounding then at the time of maturity A. The maturity value formula is V P x 1 rn.

How To Calculate Irr Internal Rate Of Return In Excel 9 Easy Ways In 2022 Excel Calculator Cash Flow

Maturity Value Formula Calculator Excel Template

Free Online Altman Z Score Calculator At Www Investingcalc How To Get Rich Investing Money Investing

Maturity Value Formula Calculator Excel Template

Excel Recurring Deposits Maturity Value Calculator Spreadsheet Free Download

Maturity Value Formula Calculator Excel Template

How To Calculate The Maturity Value Of Fd Compound Interest For An Amount Of 100000 At 6 3 Quarterly Rests Period 666 Days Using A Calculator Quora

Finding Maturity Value And Compound Interest Compounded Annually Number Sense 101 Youtube

Maturity Value Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Investment Account Calculator

Future Value Calculator With Fv Formula

Compound Interest Calculator With Formula

Ba Ii Plus Calculator Compound Interest Present Future Values Youtube

Maturity Value Formula Calculator Excel Template

Maturity Value Formula Calculator Excel Template

Future Value Calculator Basic